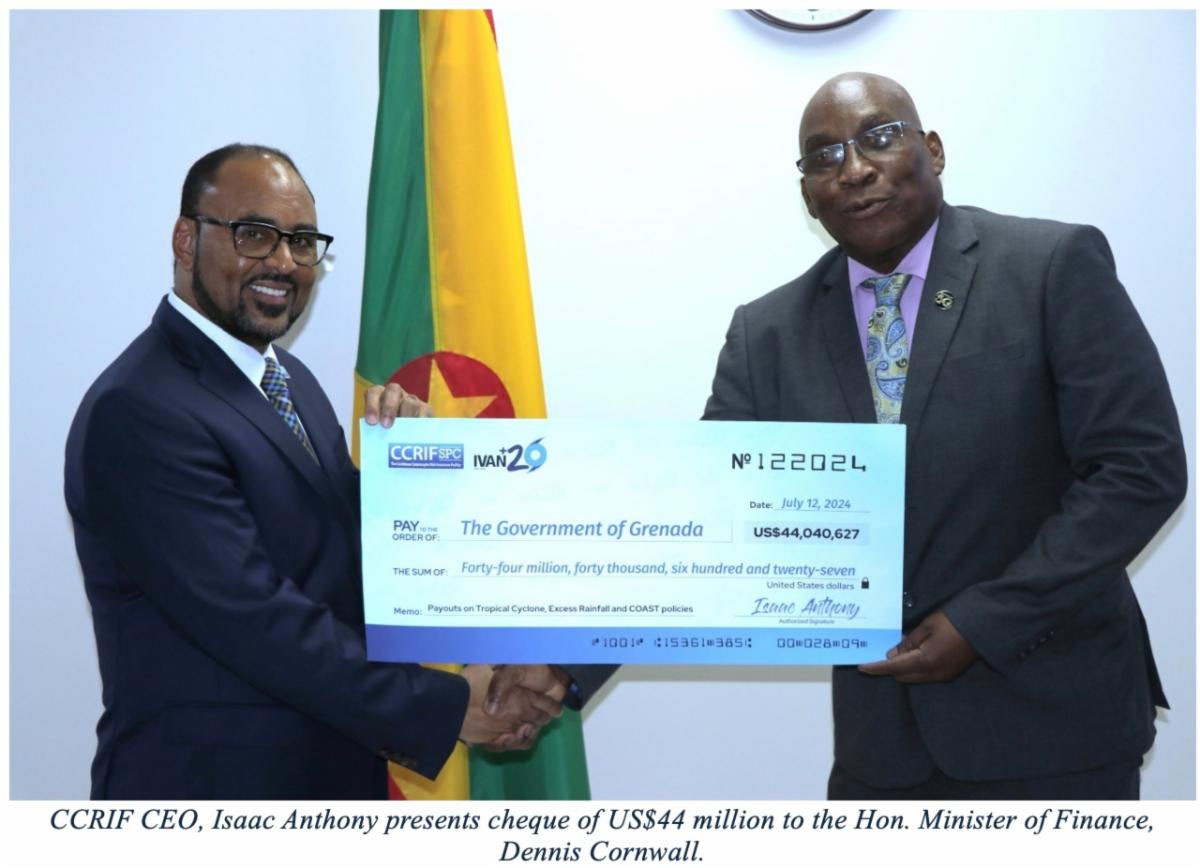

Grenada, July 19, 2024. On July 11, CCRIF Chief Executive Officer, Mr. Isaac Anthony and members of the CCRIF team met with Grenada’s Prime Minister, Hon. Dickon Mitchell; Minister of Finance, Hon. Dennis Cornwall and other key officials to present the payouts totalling US$44 million for the triggering of the Government’s tropical cyclone, excess rainfall and COAST (fisheries sector) policies, following damage from Hurricane Beryl. Both teams took the opportunity to further discuss the importance of disaster risk financing and financial protection for the country, as well as the insurance penetration rates in the Caribbean and the multi-hazard environment that the Caribbean exists in.

Mr. Anthony reminded the team that CCRIF is the Caribbean and Central America’s development insurance company and therefore, “the Facility is committed to improving the resilience of the Caribbean and Central America to climate change and natural hazards to help them to recover faster following natural disasters by providing access to quick liquidity, which can help countries to build back better”.

Mr. Anthony reminded the team that CCRIF is the Caribbean and Central America’s development insurance company and therefore, “the Facility is committed to improving the resilience of the Caribbean and Central America to climate change and natural hazards to help them to recover faster following natural disasters by providing access to quick liquidity, which can help countries to build back better”.

The Prime Minister indicated that, “while these funds [from CCRIF] may not cover all rebuilding costs, they will enable us to begin the journey of restoration of our homes, our communities and our nation”. This is exactly what CCRIF was set up to do – to fill the liquidity gap and provide an injection of liquidity following a natural disaster to allow members to begin recovery efforts.

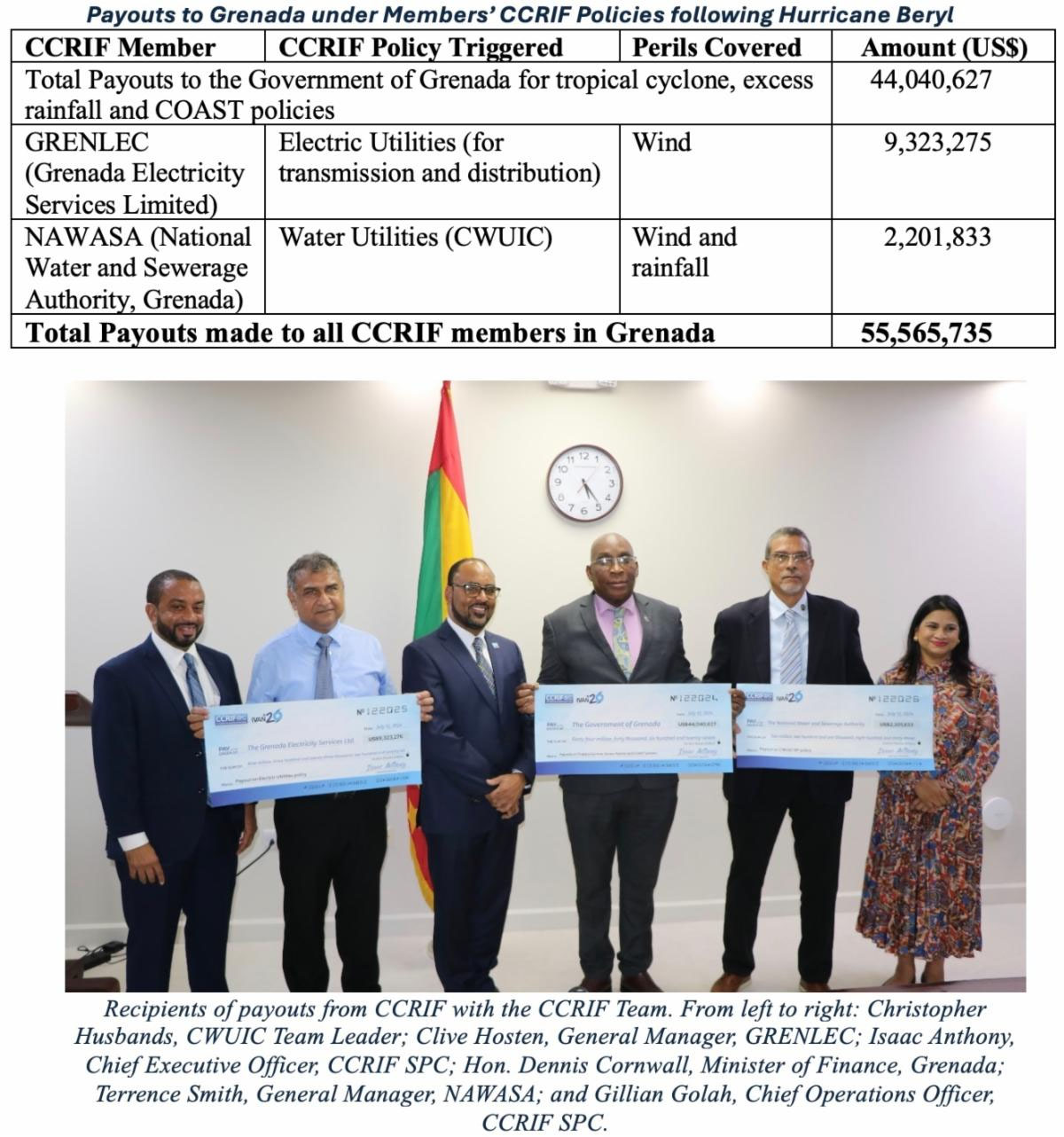

In addition to the US$44 million paid to the Government of Grenada, CCRIF made payouts to both the electric and water utility companies in Grenada under their policies. These payouts to the Grenada Electricity Services Limited (GRENLEC) and the National Water and Sewerage Authority (NAWASA), represent the first payouts made by CCRIF for policies for electric and water utilities since these two products were launched.

Between the Government of Grenada and the water and electric utilities, Grenada has all 6 parametric insurance policies CCRIF has on offer – tropical cyclone, excess rainfall, earthquake, and for the fisheries and electric and water utility sectors. The CCRIF CEO reiterated the importance of countries financially protecting their economies and stated that, “Grenada is a best practice example for other small island states in ensuring that its economy is financially protected and also taking steps to ensure that key economic sectors are also financially protected.” He further stated that, “Governments must view electricity and water as public goods, even when they are privately managed, as without either, economic growth and development prospects continue to be stymied even after a disaster.” CCRIF is working with Caribbean electric and water utilities to encourage them to obtain the respective policies. However, Mr. Anthony pointed out that, “not all countries at this time can fully adopt a risk layering approach, as not all countries have access to the various disaster risk financing options other than CCRIF parametric insurance that are available.”

Between the Government of Grenada and the water and electric utilities, Grenada has all 6 parametric insurance policies CCRIF has on offer – tropical cyclone, excess rainfall, earthquake, and for the fisheries and electric and water utility sectors. The CCRIF CEO reiterated the importance of countries financially protecting their economies and stated that, “Grenada is a best practice example for other small island states in ensuring that its economy is financially protected and also taking steps to ensure that key economic sectors are also financially protected.” He further stated that, “Governments must view electricity and water as public goods, even when they are privately managed, as without either, economic growth and development prospects continue to be stymied even after a disaster.” CCRIF is working with Caribbean electric and water utilities to encourage them to obtain the respective policies. However, Mr. Anthony pointed out that, “not all countries at this time can fully adopt a risk layering approach, as not all countries have access to the various disaster risk financing options other than CCRIF parametric insurance that are available.”

The complete list of payouts to Grenada – the Government and the electric and water utility companies – for Hurricane Beryl is presented below.

As of the new policy year, which began on June 1, 2024, CCRIF has 30 members: 19 Caribbean governments, 4 Central American governments, 3 electric utilities, 3 water utilities and 1 tourist attraction. Other countries that have received payouts following Tropical Cyclone Beryl are: St. Vincent and the Grenadines, Trinidad and Tobago, Jamaica, and the Cayman Islands. Since the inception of CCRIF in 2007, CCRIF has made 75 payouts totalling US$385,509,438 to 21 of its 30 members in the Caribbean and Central America.

As of the new policy year, which began on June 1, 2024, CCRIF has 30 members: 19 Caribbean governments, 4 Central American governments, 3 electric utilities, 3 water utilities and 1 tourist attraction. Other countries that have received payouts following Tropical Cyclone Beryl are: St. Vincent and the Grenadines, Trinidad and Tobago, Jamaica, and the Cayman Islands. Since the inception of CCRIF in 2007, CCRIF has made 75 payouts totalling US$385,509,438 to 21 of its 30 members in the Caribbean and Central America.

In keeping with CCRIF’s value proposition, all payouts are made within 14 days of the event to allow countries and sectors to begin recovery efforts. CCRIF CEO, Mr. Anthony, reminds members that CCRIF was not set up to cover all the losses on the ground, but to provide quick liquidity after a natural hazard event. However, he stresses that “while CCRIF’s payouts may be relatively small compared to the overwhelming cost of rebuilding, governments have expressed appreciation for the rapid payouts, which they are able to use to address immediate priorities and to support the vulnerable.” Governments have used CCRIF payouts for a variety of purposes, including providing food, shelter, medicine and building materials to affected persons; immediate recovery and repair activities; stabilizing facilities such as water treatment plants; supporting key economic sectors such as agriculture and tourism; and implementing mitigation activities to increase resilience, for example, improving critical infrastructure such as roads, drains, bridges, schools and other buildings and enhancing early warning systems. CCRIF’s assessments based on monitoring the use of payouts by members have revealed that its payouts have benefitted over 3.5 million persons in the Caribbean and Central America.

Recognizing that the financial protection gap is still wide and the insurance penetration rate across the Caribbean and Central America is still low despite the number of parametric insurance products that the Facility has on the market, CCRIF continues to develop additional products. Currently under development by CCRIF are products for slow onset events such as drought, a multi-peril agricultural insurance product, and a product for fluvial flooding.